Tracking, Building, and Coaching Around Sales Pipeline Metrics and Stages

As a sales manager, part of your job is to manage pipeline so you can positively influence your reps to keep deals moving forward and ultimately close them. But according to Harvard Business Review, 61% of sales leaders say their managers haven’t received sufficient training on effective sales pipeline management. Who knows how many opportunities they’re missing because of it?

If you’re not managing your pipeline, you’re not maximizing your revenue potential. An awareness of the accounts in your sales pipeline isn’t enough. You need to build your pipeline intentionally, actively track relevant sales pipeline metrics, and coach your sales reps and account executives to help convert those prospects into customers.

A healthy sales pipeline should be full and fluid. How can you ensure you have a constant stream of qualified prospects flowing into your pipeline and keep them moving through your pipeline?

- Build a quality sales pipeline. The quantity of deals in your pipeline becomes obsolete if those accounts don’t match your ideal customer profile (ICP). This is clutter that will clog up your pipeline and waste valuable time and energy.

- Track sales pipeline analytics. Tracking the right sales pipeline metrics will help you analyze the health of your pipeline, see which deals are stuck and at what stage, and inform how you coach your reps.

- Coach your team. Facilitate regular pipeline reviews, 1:1 coaching sessions, and team meetings to better understand how you can help move pipeline and equip your reps to succeed.

In this post, I’ll break down how to build a pipeline in sales, 8 critical sales pipeline metrics you need to track, and how to coach your team at various sales pipeline stages.

8 Sales Pipeline Metrics You Need to Be Tracking

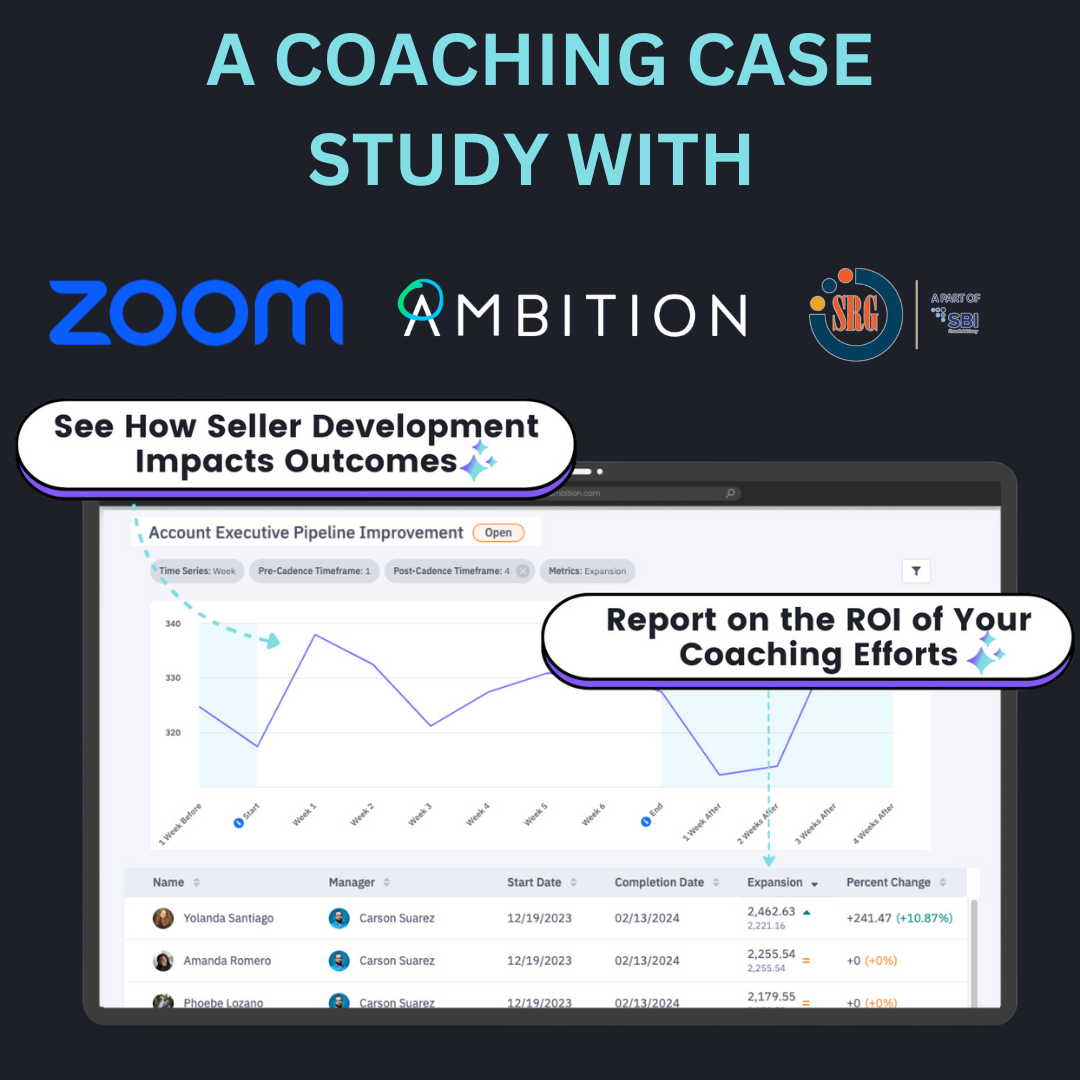

It’s important to consider where and how you track sales pipeline metrics. Efficient sales tracking tools should keep your metrics organized, visible, and easily accessible for coaching opportunities and pipeline reviews. Although I primarily use Ambition to track sales pipeline analytics, we also rely on our Gong and Salesforce integrations.

\Tracking the right sales pipeline metrics helps you minimize risk. There will always be certain metrics beyond your control, but keeping an eye on rep and revenue performance—and making sure you review these metrics with your team regularly—can help you stay ahead of potential roadblocks and keep your pipeline flowing. If you’re not sure which metrics you should be tracking, start with this list of proven KPIs.

- Sales Accepted Leads/Meetings Created

What it is: A sales accepted lead (SAL) is a marketing qualified lead that has been formally reviewed, matches your ICP, and is ready to hand over to the sales team for a meeting.

Why you should track it: If a rep does not consistently hit quota, convert sales qualified leads (SQL) to close at expected rate, or move pipeline through the right stages, you can look at the number of SALs to determine if they are actually building pipeline or backfilling.

- Sales Qualified Leads Created

What it is: A sales qualified lead (SQL) is a SAL that a rep has made contact with and deemed a “qualified” potential customer. SQLs have expressed enough interest in your product or service and are ready to enter the sales process.

Why you should track it: Tracking SQLs can help you understand how effective your prospecting and marketing efforts are. (See #3 below!)

- SAL > SQL Convert Rate

What it is: This is the percentage of SALs that become SQLs, meaning a rep has made contact with them and qualified them based on their sales readiness and your ICP.

Why you should track it: Converting a SAL to SQL is a great indicator of effective discovery and qualifying pipeline on the part of your reps. Although this is an early-stage pipeline metric, it reflects rep performance and skill level. We set a benchmark of 40% SAL > SQL conversion rate in Ambition.

- SQL > Closed/Won Conversion Rate

What it is: Once an SQL enters the pipeline, your reps are responsible for following up, continuing discovery, and moving the SQL forward. SQL > closed/won is the percentage of SQLs that become customers.

Why you should track it: This metric is harder to control because even if your reps are pulling out all the stops, a lot rests on the SQL, and things don’t change overnight. We like to look at this in conjunction with pipeline in certain stages. It helps you dig deeper into where deals are getting stuck and coach reps on areas of opportunity.

- Aging SALs

What it is: These are leads that have been sitting in the SAL stage and not moved forward for one reason or another.

Why you should track it: Not only do you want to move that SAL forward, you also want to understand why it hasn’t converted to SQL. While some of that responsibility lies with the SAL, this is an opportunity to coach your reps on follow-up strategies.

- Stuck Deals

What it is: These are deals that are stuck in the pipeline. For whatever reason, they haven’t moved forward. We track this metric a few different ways in Ambition: $ in demo stage > 30 days, $ in proposal stage, and $ open pipeline.

Why you should track it: Obviously, you want to keep pipeline flowing. Knowing which deals are stuck enables you to get with the responsible reps and AEs and dig into how you can help them get the deal moving forward. I regularly ask reps if they’re feeling stuck in any deals, but we also automate reporting of this in Ambition using leaderboards and recent value metrics.

- Average Deal Size

What it is: Average deal size is the average amount of revenue you get per deal. You can calculate this by dividing your total revenue within a month/quarter/year by the number of closed/won deals within that time period.

Why you should track it: While this metric isn’t entirely within a rep’s control or reflective of their performance, tracking average deal size still enables valuable coaching opportunities. You can ask reps discovery questions such as, “Who’s the SDR leader at X Company? Would they find value in our product?” This opens up conversations about total headcount and getting referrals to expand opportunities. It gives you a better sense on which accounts might give you the most bang for your buck.

- Average Sales Cycle Length

What it is: This is the length of time from initial contact with a prospect to closing a deal. You can calculate this by dividing the number of days it takes to close a deal by the total number of closed deals.

Why you should track it: This metric reveals a lot about your sales process. Is it efficient and effective? Do deals tend to get stuck in a certain stage of the pipeline? A lengthy sales cycle indicates that your process may need improvements or that your team needs coaching in a specific pipeline stage.

How to Structure a Pipeline Review Around Sales Pipeline Metrics

While you and your team can monitor sales pipeline metrics throughout the week via sales tracking tools like leaderboards, making time to discuss the status of your sales pipeline, what’s getting in the way of a deal, and what you can do to keep pipeline moving with your team is essential. This touchpoint will help you understand what’s going on from both a rep and prospect perspective. How does the rep feel about their accounts? How are prospects engaging (or not engaging) with reps? With this information, you can create a strategy to keep things flowing.

Tracking sales pipeline metrics gives you a consistent framework for pipeline reviews and allows you to see progress week over week, so you can see what’s likely to close or where deals are getting stuck. At Ambition, we run pipeline reviews in two formats: through group check-ins in our Monday team meeting and as part of weekly 1:1s with reps. Here are the main metrics we focus on and why:

- SAL > SQL: Shows top-of-funnel conversion

- $ in demo stage >30 days: This is often where deals get stuck

- # opportunities with >4 contacts: Shows multi-threading contacts on opportunities, and we want to see this trend up over time

- $ in proposal stage: These deals are what typically drive our forecast and have late stage objections, key mutual action plans, and close plans that require coaching gameplanning

- Overall $ in open pipeline (SQL and beyond): This keeps us accountable to our conversion rate goal of 20% SQL > close won conversion rate. We look for about 5X that goal

How to Build a Pipeline in Sales

Remember, a full pipeline doesn’t mean much if it’s not actually flowing. You want to make sure the potential deals in your pipeline have a good chance of closing. So, how do you build a healthy sales pipeline? First, you have to determine if a prospect meets your qualifying criteria. In order to enter your pipeline, a prospect should have 3 qualities:

- A clear need for your product/service

- The budget to purchase your product/service

- Decision-making authority within their company

Those are the leads you’re looking for, and there are two ways to find them: Inbounding and outbounding.

Inbounding

Inbound leads are those who find the content, videos, templates, or other free resources you produce valuable enough to engage with. Inbounding is a joint effort between marketing and sales, because you must understand the pain points your product solves for and meaningfully communicate the how of this to potential customers. This is an effective way to build your sales pipeline because the people who engage with your marketing materials already view you as a trusted source.

Outbounding

While inbounding is buyer-driven (in conjunction with your marketing efforts, of course), outbounding is seller-driven. Outbounding happens when your SDRs make cold calls, send LinkedIn messages, or cold emails to potential prospects. These people may not even be interested or qualified, but outbounding is still an effective and necessary activity to help you build pipeline. It might sound like a shot in the dark (sometimes it is), but you can be strategic by contacting potential prospects who work in the industries or regions you typically serve. There are probably tons of people out there who need what you’re selling—they just haven’t heard of you yet.

How to Coach AEs to Outbound to Build Sales Pipeline

You need both inbound and outbound efforts to build your sales pipeline. But inbound and outbound leads come to your solution from two different avenues. Inbound leads have a good understanding of who you are and what you do, while outbound leads may not. This means you’ll need to nurture and communicate with those leads differently. This will influence how you nurture and sell to them, and, in turn, how you coach your AEs to do this effectively.

An inbound opportunity typically means that there is an existing initiative to buy a solution like yours, someone driving a buying process, potential budget, and also potential competition. You should coach your AEs to approach these deals more as “evaluations” than they might an outbound opportunity. Outbound opportunities will probably start off more educational. While they’re interested enough in what you’re selling, they’re not as familiar with it as an inbound lead. Coach your AEs on asking the right discovery questions to help uncover a prospect’s pain points so they can prove your solution’s value.

Sales Pipeline Stages

The sales pipeline is a journey. Filling your pipeline is important, but converting those prospects into customers is your ultimate goal, which is why you should be coaching your team throughout every stage of the sales pipeline. Here are the different sales pipeline stages and what you should aim to accomplish in each different stage.

How to Coach Reps to Advance Deals Forward Through Pipeline Stages

Ensuring your team is equipped with the right tools, skills, and support throughout each pipeline stage will enable them to positively impact the sales pipeline metrics within their control. Here are some of the coaching questions I ask to help uncover problems, develop strategies and solutions, and set my team up for success throughout different pipeline stages.

- Are we identifying and uncovering real, quantifiable pain that goes beyond surface level discovery?

- Are we understanding a prospect’s business and how our product can fit in versus the other way around?

- Are we communicating effectively with VP or C-level decision-makers about how our solution aligns with their business initiatives?

- Do we have a real champion(s) in a deal? Someone who is willing to put their social/political clout on the line to make sure our solution is a priority?

- Do we understand a prospect’s buying process (i.e. technical requirements, security documentation, infosec process, legal/procurement processes, any kind of competitive requirements)?

- Is there a critical date we can attach an Ambition initiative to (i.e. SKO, hiring class roll out, new sales process/methodology, start of a new quarter/half, new initiative, new tool roll out like CRM or cadencing/coaching tools, etc) that matters to the prospect as much as it matters to Ambition?

Back

Back