So much goes into enterprise sales: Engaging prospective customers, managing pipelines, and closing deals, and the list goes on.

For sales managers in the hyper-cutthroat world of Enterprise SaaS (Software-as-a-Service), it is especially imperative to occasionally stop, pause for a moment, and reassess overall approach. Where are strengths and weaknesses? Which aspects of our enterprise SaaS sales process are working or not working? And so forth.

For these reasons, I urge sales managers in the Enterprise SaaS space to take a few minutes, pull back from the minutae that eat up much of your day and engage in some worthwhile, big-picture reflection.

To assist in this process, go right to the heart of the processes, personnel, and product features that factor heavily into the success of your particular enterprise sales team. Get your yoga mat, take a deep breath, and look at these 6 broad-scope questions.

Question 1. Is My Enterprise SaaS Sales Team Targeting the Right Buyers?

This question goes towards your product-market fit and ability to take on large organizations. When targeting potential customers, it might seem natural to go after the big fish first. After all, the bigger the organization, the greater the number of potential users, and thus potential revenue.

Unfortunately, this is where Enterprise SaaS sales team's enter the big catch-22 of the industry: The bigger the organization you're selling into, the longer and more difficult the enterprise SaaS sales process becomes.

How difficult is selling into a large scale company? Difficult enough for SaaS expert Mark Cranney to once muse that "selling an enterprise-wide deal is a lot like getting a bill passed in Congress."

The bottom line: It may behoove your company or, on an individual level, your sales reps to go after more specific, targeted organizations rather than head straight for the industry titans.

Question 2. How Can Our Enterprise SaaS Sales Process Help Minimize Customer Churn?

Minimizing customer turnover, or "churn," is pivotal to an enterprise SaaS company's success. As such, the duty for minimizing churn falls not just to your engineerings and customer success teams, but your enterprise sales team as well.

If you're seeing high churn amongst your current customers, it might be time to re-evaluate the types of organizations you are going after. As Mark Cranney's below graph shows, it is already difficult enough for SaaS companies to start seeing a profit on their sales once they begin selling -- if your churn rate is high, that upward swing that will get your company back into the black will be much more pronounced.

Ultimately, this goes back to the prior point: Your sales reps should understand your prospective customers and know where there is the greatest product-market fit before engaging prospective customers.

Question 3. How Does Our Enterprise SaaS Product Align Incentives?

With SaaS, the idea is that your product will, in some way, change the behavior of the organization into which your selling. And as Redpoint Ventures investor and SaaS expert Tomas Tunguz notes, "product is the strongest and most persistent way of changing behavior."

The best SaaS products don't just impact an organization at one level, they align incentives across the board, from the very top of the organization to the very bottom.

As noted in the 2012 SaaS Inside Sales Report, company decision-makers listed "'widespread support for the supplier across my organization'" as the top item they cared about when making a buying decision involving a SaaS product.

Your sales reps therefore must know how to accentuate and emphasize your product's benefits across all levels of the organization, as a means of reinforcing that all-important end-game of your product: Maximizing R.O.I. to the prospective buyer.

Question 4. Are We Prepared to Close at the C-Level?

An experienced SaaS sales rep recently told me a great analogy regarding this point:

"When you're targeting who direct your sales pitch to in SaaS, think about it like you're a car salesman, and a father and his 16 year old son walk onto your lot. You want to impress the kid, but at the end of the day, the father is going to be the one pulling out the wallet."

Users and middle-management might love your product, but in most cases, the C-Level Executive is the person you're going to need to close at the end of the day.

Ensure that your reps understand what it will take to close this person early in the game and start chipping away at that from the very beginning of the process.

Question 5. What is Our Plan for Overcoming Inertia?

Resistance to change, while a major obstacle in other industries, is especially formidable in SaaS.

As Cranney astutely notes: "Your biggest competition isn’t just other startups, perpetually licensed on-premise packages, homegrown solutions, or incumbent vendors. It’s inertia. Enterprise/SaaS salespeople find themselves in a constant battle against the target company’s urge to do nothing."

For this reason, an Enterprise SaaS sales team should make combating a company's "urge to do nothing" one of the first obstacles it tackles when engaging a prospective customer. Find a pain and reveal a problem wherein your product is the solution.

Question 6. Are We Properly Managing Our Enterprise SaaS Sales Team?

The best sales reps will understand product-market fit, know how to attack at the C-Level, and overcome objections based on risk-aversion and intertia. An important sub-question for sales managers thus becomes: Am I using a sophisticated means of measuring sales force performance?

Hubspot provides a great example of how they have utilized sophisticated sales rep performance metrics to measure enterprise team productivity. As set forth in a blog post by David Skok, Hubspot looks at three criteria when determining the success of each rep, as demonstrated below:

- Average quota attainment %

- PPR – Productivity Per Rep

- LTV – Life Time Value of the customers that they signed up.

If you have an enterprise SaaS sales team, you should be measuring your personnel on unique metrics different from those of the average sales team. Determining quality of performance goes beyond merely measuring how many sales are made.

I would advise following Hubspot's lead in taking an innovative approach to measuring processes and people. Or in the words of Peter Drucker, "follow effective action with quiet reflection. From the quiet reflection will come even more effective action."

If you are an Enterprise SaaS sales manager, I encourage you to take a minute and visit these questions in your own head, and also share them with your sales team. Solicit feedback, discuss your thoughts, and remember that no matter how well you are performing, there is always room for improvement.

Drive SaaS Sales Performance and Accountability

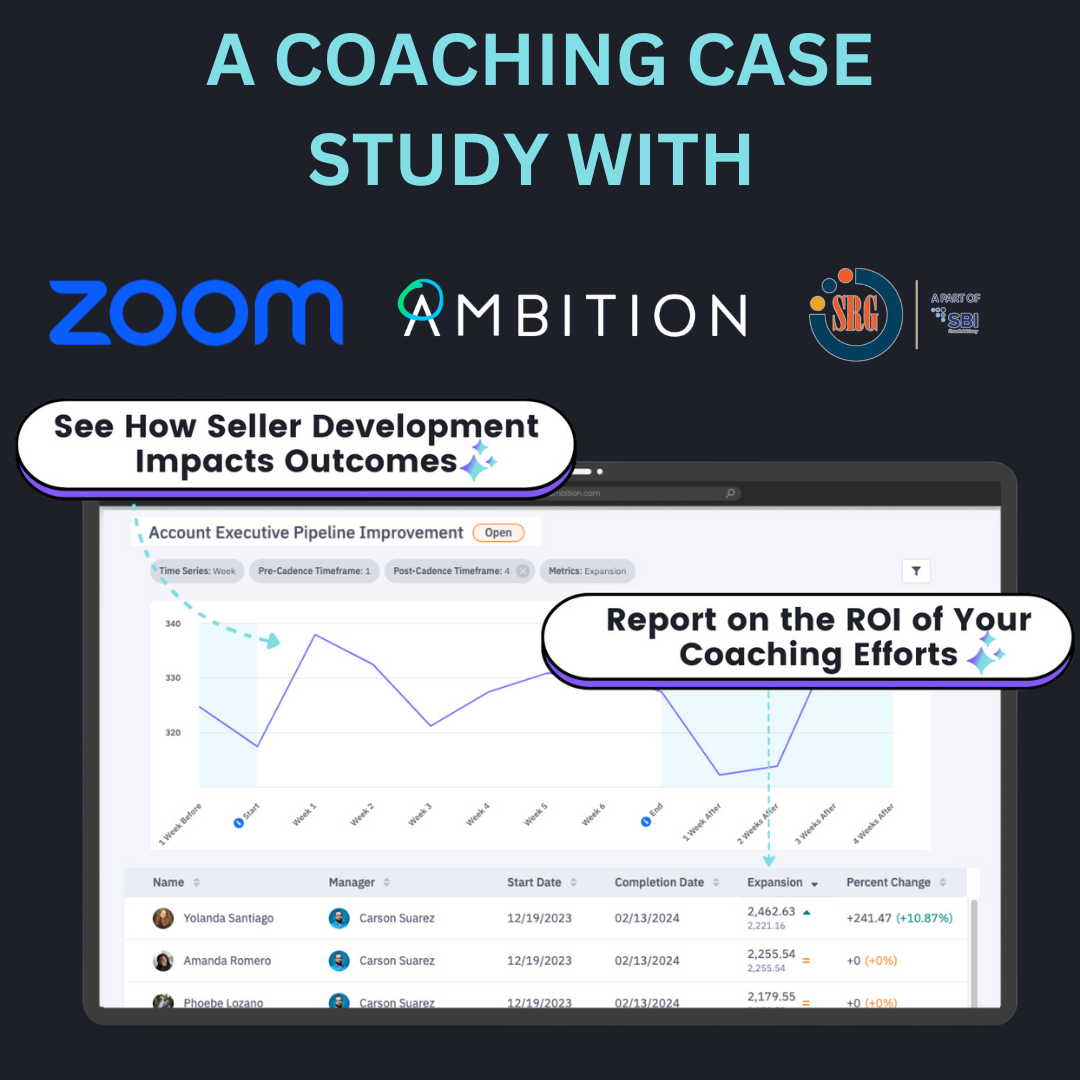

Ambition is a sales management platform that syncs every sales department, data source, and performance metric on one system.

SaaS companies like MemSQL, FiveStars and Outreach use Ambition to enhance sales accountability. Ambition's drag-and-drop interface lets non-technical sales leaders create custom sales scorecards, contests, reports, and TV leaderboards with live data.

Ambition is endorsed by Harvard Business Review, AA-ISP (the Global Inside Sales Organization), and USA Today as a proven solution for managing activity-driven sales teams. Visit our AppExchange page and hear from our clients below.

Watch Testimonials:

- FiveStars: Adam Wall. Sr. Manager of Sales Operations .

- Filemaker: Brad Freitag. Vice-President of Worldwide Sales.

- Outreach: Mark Kosoglow. Vice-President of Sales.

- Cell Marque: Lauren Hopson. Director of Sales & Marketing.

- Access America Transport: Ted Alling. Chief Executive Officer.

Watch Product Walkthroughs:

- ChowNow. Led by Vice-President of Sales, Drew Woodcock.

- Outreach. Led by Sales Development Manager, Alex Lynn.

- AMX Logistics. Led by Executive Vice-President ,Jared Moore.

Read Case Studies:

- Clayton Homes: HBR finds triple-digit growth in 3 sales efficiency metrics.

- Coyote Logistics: Monthly revenue per broker grew $525 in 6 months.

- Peek: Monthly sales activity volume grew 142% in 6 months.

- Vorsight: Monthly sales conversations grew 300% in 6 months.

Contact us to learn how Ambition can impact your sales organization today.

Back

Back