Your company uses Salesforce.com as its CRM. You're a key decision-maker on a major software initiative that's come down to two providers. One is a 100% Native Salesforce App. The other is an ISV partner. Should that influence your buying decision? And if so, in what ways and to what degree?

It's hard to know who to trust when asking the question: "Native or Non-Native?"

Both vendors will give you the same answer: "Mine."

A contractually-obligated SFDC consultant will answer: "Native."

A Google search will pull up blog posts by 100% native Apps telling you: "Native."

This blog post is about to straighten that out.

Native vs Non-Native Salesforce Apps: Analysis

We scoured the internet for "Best-Reviewed Salesforce Apps," found a ton of helpful blog posts on the subject and went through each highly-ranked App to discern which were native and non-native.

Our analysis of 40 top-reviewed AppExchange vendors delivers an answer to the "Native vs. ISV" question - and it's backed by cold, hard data.

Native vs Non-Native Salesforce Apps: Background

With Native apps, everything is built directly into Salesforce.com and operates purely inside of SFDC; no external servers or code.

Non-Native apps run both inside and outside of Salesforce.com. Their platforms integrate with SFDC via APIs or middleware.

Which is better? That answer will depend on the integration quality and robustness of the non-native app.

Native vs Non-Native Salesforce Apps: Evaluating the Top 40

In general, who creates best the user experience for Salesforce clients: Native or Non-Native Apps?

The best answer to that question comes from one place - the users themselves.

We curated a list of the 30 highest-reviewed paid Apps on the AppExchange, then identified which Apps were Native and which were Non-Native.

The answers might surprise you.

To get our top 30 list, we used the following 3 sources and limited our list to Apps used by Sales, Marketing and Customer Success teams.

- Docurated: Top 17 Apps on the Salesforce AppExchange

- AppExchange: Most Popular Paid Apps (4+ Rating Only)

- AppExchange: Most Popular Paid Apps for Sales (4+ Rating Only)

Here's the Top 30 list:

- Adobe eSign. ISV

- Cirrus Insight. ISV

- Conga Composer. ISV

- Clicktools. ISV

- DialSource. Native.

- Email to Case Premium. Native.

- SalesGenius. ISV

- Act-On. ISV

- Bizible. ISV

- Accounting Seed Financial Suite. Native.

- JobScience. Native.

- AscentERP. Native.

- Taskray Project Management. Native.

- FunnelSource. Native.

- DocuSign. ISV

- LinkPointConnect. ISV

- DrawLoop. Native.

- MapAnything. Native.

- GeoPointe. Native.

- PowerDialer. ISV

- CalendarAnything. Native.

- SteelBrick CPQ. Native.

- GridBuddy. Native.

- Cloudingo. Native.

- Skuid. ISV

- ActionGrid. Native.

- Veeva CRM. ISV

- iHance (Acquired by ISDC). ISV

- Yesware. ISV

- Apptus. ISV

Well, look at that. Of the 30 highest-rated Salesforce.com Apps, 15 are Native Apps and 15 are Non-Native Apps.

Also worth noting: None of these massive Non-Native Partners made the "top-reviewed" list.

- Box. (AppExchange Listing).

- Clearslide. (AppExchange Listing).

- Xactly. (AppExchange Listing).

- Gainsight. (AppExchange Listing).

- Zuora. (AppExchange Listing).

- Tableau. (AppExchange Listing).

- Domo. (AppExchange Listing).

- Dropbox. (AppExchange Listing).

- SurveyMonkey. (No AppExchange Listing).

- Workday. (No AppExchange Listing).

Evidence that Non-Native Apps offer poor user experience? Hardly. The top 5 vendors in this list actually have a higher volume of positive reviews than most of the native Apps in our Top 30 list.

Native vs ISV Salesforce Apps: What the Data Says

What does all this tell us? Any App that tries to tout "100% Native" or "Non-Native" as its trump cards over a competing app is being disingenuous. Several important things to consider:

1) Native Apps can only sell to Salesforce clients. Which means:

- AppExchange reviews are the lifeblood of Native Apps.

- Salesforce pushes Native App investments over Non-Native apps.

- Native App marketing teams created the Non bogeyman.

2) Non-Native Apps can sell to both clients and non-clients. Which means:

- Non-Natives tend to be marketed less on the AppExchange.

- Non-Natives tend to receive fewer AppExchange downloads.

- Non-Natives don't think in terms of 'native vs non-native.'

3) Salesforce Apps are like any other business software. Which means:

- Non-Natives tend to be pricier than Native Apps.

- Native Apps serve a niche; ISVs serve a spectrum.

- Non-Native and Native App quality can vary dramatically.

The bottom line: Prospective buyers should appraise Salesforce Apps on their own merit. Not on whether they live 100% natively within Salesforce.

Native vs Non Salesforce Apps: Case-By-Case Basis

If you read vendor arguments for or against Native or Non-Native Apps, you'll get pure, unadulterated marketing spin.

As with any software vendor, client reviews, success stories, pricing, press coverage and technical documentation should win the day for your competing SFDC apps.

When it comes to Native vs Non-Native, making the right decision is no big secret. Select the App that best aligns with your needs. If one of those needs is increased data visibility, employee motivation and accountability, or CRM adoption, check out Ambition's AppExchange page and see how we can help.

Drive Salesforce Success with Ambition

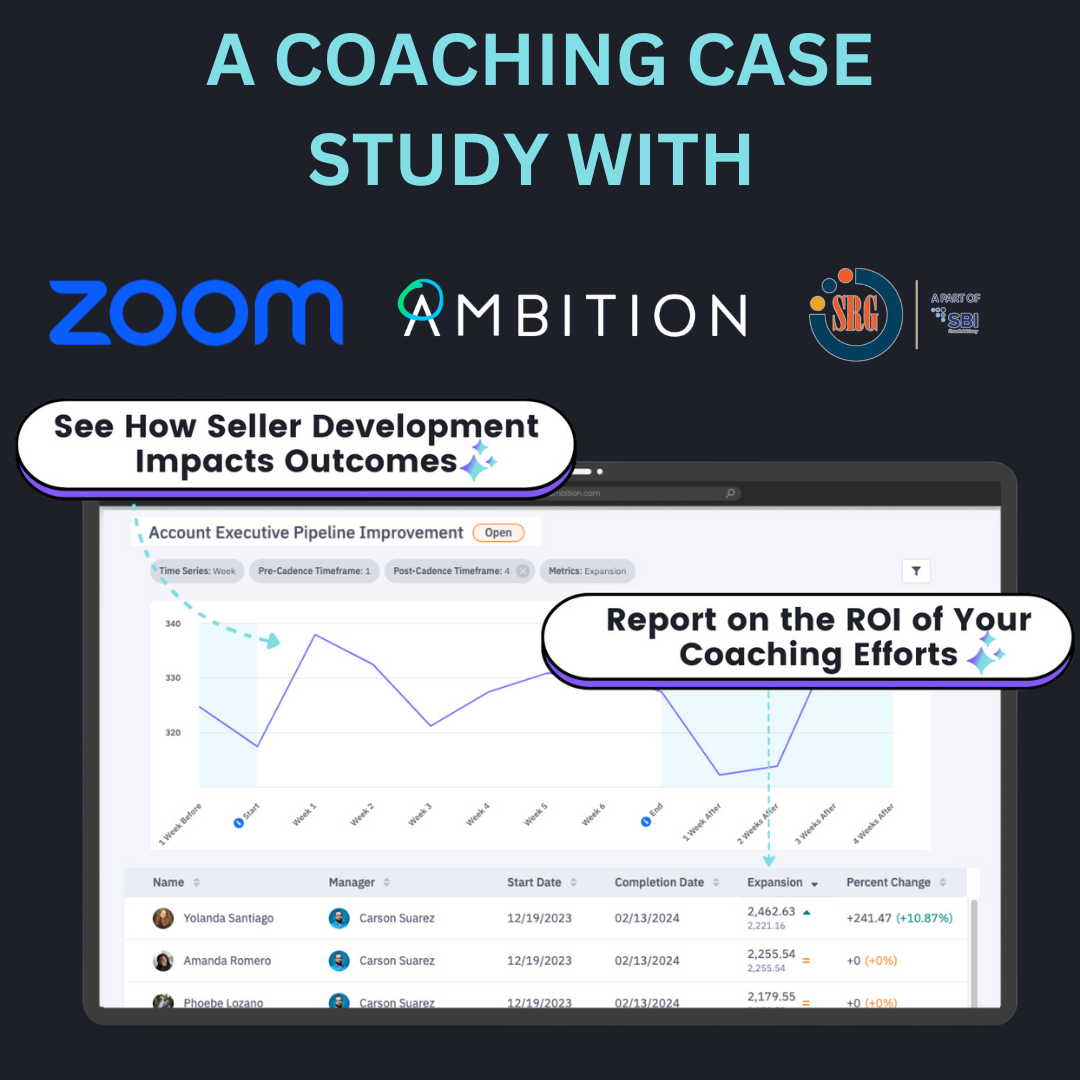

Ambition is a sales management platform that syncs every sales department, data source, and performance metric on one system.

Salesforce clients use Ambition to enhance sales performance visibility. Ambition's drag-and-drop interface lets non-technical sales leaders create custom sales scorecards, contests, reports, and TV leaderboards with live Salesforce data.

Ambition is endorsed by Harvard Business Review, AA-ISP (the Global Inside Sales Organization), and USA Today as a proven solution for managing activity-driven sales teams. Visit our AppExchange page and hear from our clients below.

Watch Testimonials:

- FiveStars: Adam Wall. Sr. Manager of Sales Operations .

- Filemaker: Brad Freitag. Vice-President of Worldwide Sales.

- Outreach: Mark Kosoglow. Vice-President of Sales.

- Cell Marque: Lauren Hopson. Director of Sales & Marketing.

- Access America Transport: Ted Alling. Chief Executive Officer.

Watch Product Walkthroughs:

- ChowNow. Led by Vice-President of Sales, Drew Woodcock.

- Outreach. Led by Sales Development Manager, Alex Lynn.

- AMX Logistics. Led by Executive Vice-President ,Jared Moore.

Read Case Studies:

- Clayton Homes: HBR finds triple-digit growth in 3 sales efficiency metrics.

- Coyote Logistics: Monthly revenue per broker grew $525 in 6 months.

- Peek: Monthly sales activity volume grew 142% in 6 months.

- Vorsight: Monthly sales conversations grew 300% in 6 months.

Contact us to learn how Ambition can impact your sales organization today.

Back

Back