With seemingly everyone and their mother climbing over each other to get a piece of some SaaS products, it goes without saying that most SaaS account executives have a pretty enjoyable gig going on right now, right?

Wrong. From the outside, it probably looks very easy. Ceiling-shattering growth numbers. Massive industry hype. Office spaces that look like something Bruce Wayne would have drawn up. The Software-as-a-Service (SaaS) industry is indeed coming on strong, and if you'd like some numbers to back that up, here's a sentence full of eye-popping figures from a May 2014 Forbes article:

"The worldwide CRM market grew 13.7% from $18B in 2012 to $20.4B in 2013, with 41% of all systems sold in 2013 being SaaS-based." Source: Forbes.

As such, SaaS companies are looking for experience, as indicated by the 2012 SaaS Inside Sales Report's finding that 2.5 years was the average experience-level of a newly hired Sales Rep, with only 8 percent of all new hires having more than a year of experience.

There's a reason SaaS companies aren't recruiting just anybody to help sell their products. The Enterprise SaaS sales process ranks among the most demanding of any technology sale on the planet. There is a a high degree of difficulty, especially for those inexperienced in selling into major accounts with 5+ decision makers.

What makes Enterprise SaaS so difficult? Better yet, what does it take to succeed? Let's start by taking a broadview look at the process itself.

Enterprise SaaS Sales: From -3 to +3

What's so hard about closing a SaaS sale? The answer is best exemplified in breaking down the mantra of the SaaS Sales Process: Getting from -3 to +3.

Negative 3 is the mentality: "I don't have a problem, or, I don't need to change." 0 is "I want your product but I don't need it now." Positive 3 is: "I want to change, the answer is your product, and I need it now."

As you can see, this process hasn't so much replaced AIDA (Attention. Interest. Demand. Action.) as adapted it to fit the main challenge of closing a SaaS deal. Namely, getting not just one person, but an organization of people to commit to your product and stay committed over time. The -3 to +3 spectrum is the path that every SaaS sales deal must follow, and it is traversed via answering three pivotal questions: Why Change? Why You? Why Now?

Let's take this trip ourselves by drilling down into each question, one-by-one.

Why Change?

Resistance to change is the initial mortal enemy of a prospective SaaS deal. And the first step toward conquering it is to figure out exactly what is going to drive a customer to change in the first place. Or as Mark Cranney describes it: "Seek first to understand and then to be understood."

Remember when you were in high school and you told your mom you wanted new clothes for Christmas, but gave no further instructions Chances are, come Christmas morning you were opening packages that contained cardigan sweaters, Tech Vests, or some other godawful crime against fashion that your mom thought would look better on you than your current wardrobe? (Mine sure did).

It's the same with SaaS sales. As Cranney elaborates, "the problem with telling a potential customer what you think they need before you understand what they think they need is: You’re basing your position on a known set of requirements from a broad base of companies instead of unknown specific opportunities."

The result: You position yourself as "more of a commodity or just a vendor — as opposed to a partner that can help transform the way they conduct their business." Only once you have discovered the needs of the prospect that will compel them to change can you effectively begin communicating your product's value. You do so by finding a pain point that you can cure, then you make the prospect see how much it hurts.

Bear in mind, the bigger the organization's potential user base and the greater the amount of change required, the more resistant the organization will likely be to embracing the change that your product offers.

Hubspot VP of Sales Mark Roberge glibly explained the challenge at hand for his sales team: "In HubSpot sales, we need to educate people over the phone and literally convince them to turn their sales and marketing process on its head." Sounds fun, right? And yet, the fact is that SaaS sales reps really are asking organizations to do the two things they hate most: change and spend money. In order for that to happen, finding out where the prospect hurts and how much it is hurting is an absolute pre-requisite on the part of the Sales Rep.

Why Your Enterprise SaaS Product?

Not only are SaaS sales reps charged with persuading an organization to go through the rigor of overhauling a major business process or processes, and spend money to do it. They're charged with convincing the organization that it's their product, and not their competitors, that is worthy of these undertakings.

The complexity of SaaS sales comes into focus here. It's not enough to have the best product, or offer the cheapest price. The deck is stacked to the point where SaaS sales reps all but have to engender something many mistakenly believe is absent from Business-to-Business sales: emotional resonance.

As the Andreesen Horowitz blog explains: "Because SaaS usage is at the departmental level, there are often many more users in a company than there have historically been from traditional software products, making switching costs even higher."

Complicating matters further is the reality that it’s "very difficult to switch SaaS vendors once they’re embedded into business workflow." You can see why SaaS sales trainer John Barrows declared definitively in his interview with Ambition, "The days of adding value are here."

And yet, in many cases, there comes a point where the last remaining competitors over a prospect are all promising a similar return on ROI, showing similar stats and figures to compel change, and promising the usual "highest level of customer support" and "commitment to ensuring success."

So if you present a compelling case guaranteeing your product's abiltiy to provide an immediate, significant strategic advantage or mitigate a strategic disadvantage -- congratulations, you've made it to the hard part. This is the point in the sale where knowing why you do your job, truly believing in your product and understanding its values becomes so pivotal.

You should compel the prospect to feel that the value your product will add will go beyond the tangible and impact the ephemereal. Adding your product into the prospect organization's will create a positive, new level of nuance within its organizational culture -- more high tech, innovative, employee friendly, youthful, cooperative - and so on.

Why Buy Now?

The final hurdle in the SaaS Sales cycle presents the most formidable challenge of all: instilling a sense of urgency in the prospect organization that induces immediate purchase.

Mark Cranney succinctly sets forth the SaaS sales rep's final task: "Once you’ve eliminated the competition and are on the path to technical validation, you have to turn the value proposition into a quantifiable business case."

In other words, when ushering a prospect through the final stage of the decision-making process, you better be prepared to eliminate any relevant unknowns and assuage any lingering concerns that may impede the purchase.

Again, here is another stage where industry practices are trending against sales reps. The Bridge Groups's 2012 SaaS Inside Sales Report found that: "Decision makers are requiring not only more information, but the support of a cadre of other stakeholders. Rarely is a decision made by just one person, this includes the CEO."

Here is where SaaS sales reps must truly put on their Consultant hats and work with the prospect to set up a concrete implementation and onboarding plan moving forward. Make no mistake, this will be a collaborative process where closing occurs not with one person, but many. The 2012 SaaS Inside Sales Report reiterated the tendency for "'risk averse decision makers [to] buy on consensus.'"

As such, the ability to communicate and coordinate with precision becomes a moral imperative for the deal to close successfully.

The Challenge of Enterprise SaaS Sales

SaaS sales mean getting your customers to marry you. That is, agree to a long-term commitment toward one another, with recurring payments. (For sales reps, the stress, uncertainty and length of the sales process can often more closely resemble a divorce).

Ultimately, we're only scratching the surface of the tremendous volume of training, pre-planning, strategizing, information gathering and marketing alignment that goes into SaaS sales.

SaaS companies fight for territory in a highly competitive jungle, which is why it is so imperative to have the right people, processes & product. Fall short in one of these key areas, and your company will soon be going the way of the Dodo bird.

There's a lot of money out there that's ready to be spent, but only on companies that have properly equipped themselves to survive the SaaS sales gauntlet.

SaaS Sales Leadership Starts with Ambition

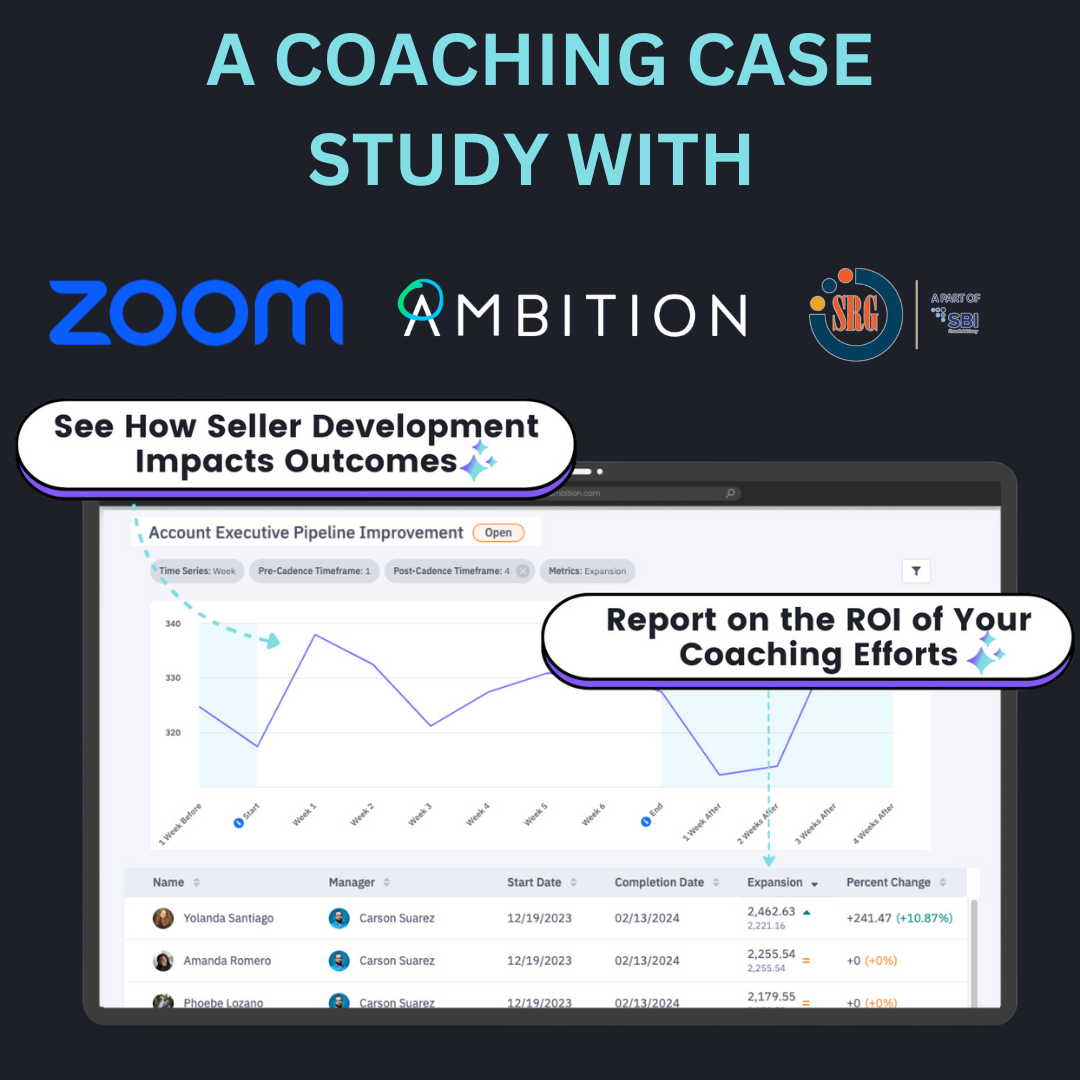

Ambition is a sales management platform that syncs every sales department, data source, and performance metric on one system.

SaaS companies like MemSQL, FiveStars and Outreach use Ambition to enhance sales accountability. Ambition's drag-and-drop interface lets non-technical sales leaders create custom sales scorecards, contests, reports, and TV leaderboards with live data.

Ambition is endorsed by Harvard Business Review, AA-ISP (the Global Inside Sales Organization), and USA Today as a proven solution for managing activity-driven sales teams. Visit our AppExchange page and hear from our clients below.

Watch Testimonials:

- FiveStars: Adam Wall. Sr. Manager of Sales Operations .

- Filemaker: Brad Freitag. Vice-President of Worldwide Sales.

- Outreach: Mark Kosoglow. Vice-President of Sales.

- Cell Marque: Lauren Hopson. Director of Sales & Marketing.

- Access America Transport: Ted Alling. Chief Executive Officer.

Watch Product Walkthroughs:

- ChowNow. Led by Vice-President of Sales, Drew Woodcock.

- Outreach. Led by Sales Development Manager, Alex Lynn.

- AMX Logistics. Led by Executive Vice-President ,Jared Moore.

Read Case Studies:

- Clayton Homes: HBR finds triple-digit growth in 3 sales efficiency metrics.

- Coyote Logistics: Monthly revenue per broker grew $525 in 6 months.

- Peek: Monthly sales activity volume grew 142% in 6 months.

- Vorsight: Monthly sales conversations grew 300% in 6 months.

Contact us to learn how Ambition can impact your sales organization today.

Back

Back